► Updated car tax for new models

► How vehicle excise duty (VED) works

► 2025 road and car tax bands explained

Only two things in life are certain: death and car tax. It’s a modern reality that motoring isn’t free – and in this guide we explain how Vehicle Excise Duty (VED), also known as car tax and road tax, works with all the changes coming on 1 April 2025.

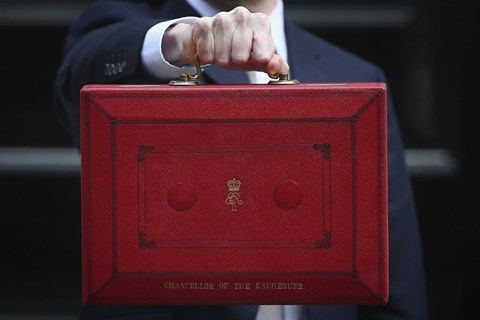

It’s now been a decade since physical tax discs were abolished in favour of digital taxation, in a measure to chop down on government spending. VED is still a major source of revenue to the UK Treasury and the autumn 2024 budget shook things up for all motorists. Gone is free road tax for electric vehicles, and most cars that contribute any CO2 at all are now facing a substantial price hike in annual road tax.

Read on to learn all about the changes coming in the next few weeks, and just how VED works in 2025.

How does car tax work?

Cars in Great Britain are taxed based on their CO2 emissions, but the age of the car is also taken into consideration when the VED car tax band is calculated. And there is also a difference between taxing a brand new car being registered for the first time (known as the first-year rate) and one that’s already on the road. We’ll explain both types in this explainer.

In this guide we will attempt to explain all the most likely road tax scenarios. First step is to establish your vehicle’s age and CO2 emissions; both are recorded on your car’s V5C registration document from the DVLA – it’s the paperwork you were sent when you first purchased the car. Carbon dioxide (CO2) emissions are quoted in grammes per kilometre (g/km) and record how efficient your vehicle is. A car with 90g/km is pretty clean; a gas guzzler may well top 300g/km or 400g/km.

It can get a bit complicated. Here we explain how much you’ll pay whether you’re taxing a brand new car, a nearly new one or an old banger. Read on for our full explainer for how car tax works in Britain.

First-year road tax VED for all new cars

If you are buying a brand new car from 1 April 2025, you’ll pay the new first-year rates of VED. These vary from a tenner for EVs, all the way up to £5490 for a highly-polluting Lamborghini Revuelto or Rolls-Royce Phantom. EVs used to get a free ride in the name of incentivising take-up, but that’s all ending from April 2025 as adoption grows. The taxation rate for EVs is still far below the rate for any vehicle with an engine, mind.

Find out your vehicle’s CO2 emissions in the first column and then read across, depending on whether your car is powered by petrol, diesel or alternative fuels (LPG or CNG autogas). If you’re reading this on your phone, you might need to flip your screen to horizontal landscape to fit it all on the screen.

| CO2 (g/km) | DIESEL CARS (TC49) THAT MEET RDE2 STANDARD AND PETROL CARS (TC48) | ALL OTHER DIESEL CARS (TC49) | ALTERNATIVE FUEL CARS (TC59) |

| 0 | £10 | £10 | £10 |

| 1- 50 | £110 | £110 | £110 |

| 51 – 75 | £130 | £130 | £130 |

| 76 – 90 | £270 | £350 | £250 |

| 91 – 100 | £350 | £390 | £330 |

| 101 – 110 | £390 | £440 | £370 |

| 111 – 130 | £440 | £540 | £420 |

| 131 – 150 | £540 | £1360 | £520 |

| 151 – 170 | £1360 | £2190 | £1340 |

| 171 – 190 | £2190 | £3300 | £2170 |

| 191 – 255 | £3300 | £4680 | £3280 |

| 226 – 255 | £4680 | £5490 | £4660 |

| Over 255 | £5490 | £5490 | £5490 |

That’s the first-year cost to tax your car. Then it gets even more complicated. Road tax in subsequent years is charged at a different rate – depending on the original list price of your car.

You have been warned…

Car tax for new cars: second and subsequent years

Ready to consider your second-year tax on a new car? Good. Check out our table below to see what you’ll pay – and remember, this only applies if your new car cost less than £40,000 when you first purchased it. That’s the full RRP list price including any options, not a haggled, discounted price.

There are thee current rates of road tax, but remember these will rise with inflation from April 2025:

| TAX CLASS | NON DIRECT DEBIT (12 MONTHS) | 6 MONTHS | DIRECT DEBIT (12 MONTHS) | TOTAL PAYABLE

BY 12 MONTHLY

INSTALMENTS | SINGLE

6-MONTH

PAYMENT |

| Petrol/diesel | £190 | £104.50 | £190 | £199.50 | £99.75 |

| Alternative fuel | £180 | £99 | £180 | £189 | £94.50 |

| Total including the £410 additional rate | | | | | |

| Petrol/diesel car | £600 | £330 | £600 | £630 | £315 |

| Alternative fuel car | £590 | £324.50 | £590 | £619.50 | £309.75 |

What’s all this about new cars costing more than £40,000 paying more road tax?

Ah yes. Bit of a killer this one: if your new car has a list price (including options and extras) of more than £40,000 at the time of purchase, you’ll have to pay even more. This is known as the ‘luxury car supplement,’ but is also known as the showroom tax. And you can’t haggle it down – the tax is charged on the quoted list price of your chosen model, including all optional equipment.

This figure has been frozen since its introduction, and the recent inflation jump now means a mid-spec Volkswagen ID.4 will count as a luxury car, once EVs are subject to the tax from April 2025. In fact, we’ve spotted both Vauxhall and Tesla reduce prices on EVs to slip under this threshold, so be sure to check the latest list prices.

We ran the original £40,000 figure through an inflation calculator and it spat out £52,400 in today’s money. If only the threshold for the tax went up in line with inflation, as VED does…

These rates apply in years two, three, four and five – so you’ll have to pay an extra £410 per year:

VEHICLE

FUEL

TYPE | ONE-OFF

ANNUAL

PAYMENT | ONE-OFF

ANNUAL

DIRECT DEBIT

| TOTAL OF

12 MONTHLY

DIRECT DEBITS | ONE-OFF

6-MONTH

PAYMENT | SINGLE

6-MONTH

DIRECT DEBIT |

| Petrol or diesel | £450 | £450 | £472.50 | £247.50 | £236.25 |

| Electric | £310 | £310 | £325.50 | £170.50 | £162.75 |

| Alternative fuel | £440 | £440 | £462 | £242 | £231 |

Car tax and VED for cars registered between 1 March 2001 and 31 March 2017

Still with us? Good. Any car registered between 2001 and 2017 will pay a flat rate of VED car tax, depending on its CO2 emissions – but here price doesn’t come in to it. The cleanest cars in Band A paid nothing, whereas the dirtiest in Band M were clocking up more than £700 a year. So check out the table below to see how much your car tax will be:

| Car tax band | CO2

emissions | One-off annual payment | One-off 6 month payment | Total of

12 monthly

direct debit | Total payable

by 12 monthly

installments | Single

6 month

payment |

|---|

| A | Up to 100 | £0 | £0 | – | – | – |

| B | 101 to 110 | £20 | £20 | £21 | – | – |

| C | 111 to 120 | £35 | £35 | £36.75 | – | – |

| D | 121 to 130 | £160 | £88 | £160 | £168 | £84 |

| E | 131 to 140 | £190 | £104.50 | £190 | £199.50 | £99.75 |

| F | 141 to 150 | £210 | £115.50 | £210 | £220.50 | £110.25 |

| G | 151 to 165 | £255 | £140.25 | £255 | £267.75 | £133.88 |

| H | 166 to 175 | £305 | £167.75 | £305 | £320.25 | £160.13 |

| I | 176 to 185 | £335 | £184.25 | £335 | £351.75 | £175.88 |

| J | 186 to 200 | £385 | £211.75 | £385 | £404.25 | £202.13 |

| K* | 201 to 225 | £415 | £228.25 | £415 | £435.75 | £217.88 |

| L | 226 to 255 | £710 | £390.50 | £710 | £745.50 | £372.75 |

| M | Over 255 | £735 | £404.25 | £735 | £771.75 | £385.88 |

So taxing some older, interesting cars such as a secondhand Porsche 911 (below) could get pricey…

Car tax and VED for older cars registered before 1 March 2001

Ah, the good, old-fashioned way to tax your car… Back in the day, road tax was calculated purely on engine size – and the magic cubic capacity was 1.5 litres. Check out our table here to see how much an older car will cost to tax (conveniently, this was introduced just as the UK’s new registration system was ushered in, with the Y-reg plate).

ENGINE

SIZE

IN CC | ONE-OFF

ANNUAL

PAYMENT | ONE-OFF

ANNUAL

DIRECT DEBIT

| TOTAL OF

12 MONTHLY

DIRECT DEBITS | ONE-OFF

6-MONTH

PAYMENT | SINGLE

6-MONTH

DIRECT DEBIT |

| Below 1549 | £210 | £210 | £220.50 | £115.50 | £110.25

|

| Above 1549 | £345 | £345 | £362.25 | £189.75 | £181.13 |

And that’s it. Complicated, isn’t it? We hope you’ve found our guide to British road car tax useful. Read on for some popular questions about road tax and VED.

Car tax FAQs

Has my car got tax?

You can check if your vehicle is taxed and can be driven on the road on this handy DVLA online service here.

How do I cancel my car tax?

It’s very easy to cancel your VED if you sell your car. If you pay by Direct Debit, it will be cancelled automatically; if you paid a one-off fee, the DVLA will automatically refund any full months left to run on your car tax. Apply for a tax refund here.

Is car tax transferable?

Sadly not. You used to be able to pass your VED on to the next buyer when you sold your car. But this was stopped in 2017. You must now apply for a refund – and the buyer will have to tax the car from scratch from the moment they drive off the forecourt. Gone are the days of throwing in ‘six months road tax included’ to sweeten a secondhand car sale.

How do I SORN my car?

If you know you won’t be driving your car on the road for a considerable length of time, you must apply for a Statutory Off Road Notification, or SORN, if you don’t want to pay road tax. We have a separate explainer here about how SORN works.

How do I contact the DVLA about my car tax?

The Driver and Vehicle Licensing Agency (DVLA) is the government body responsible for car and road tax in the UK. Contact details are listed on the DVLA website.

How is company car tax calculated?

Company car tax is a completely separate tax, designed to reflect the perk of having a company-provided business car. Note that you will have to pay for road tax as well. We recommend using the company car tax calculator on our sister website Fleet News to see how much benefit-in-kind tax you’ll pay on any business-provided car.

Do you have to pay tax on older classic cars?

Cars first registered before 1 January 1985 are currently exempt from paying VED, as of 1 January 2025. This rolling threshold advances every year, so all cars made before 1 January 1986 will be exempt from 1 January 2026. You need to apply for this road tax exemption, and can do that here.

Other exemptions include disabled motorists, mowers, agricultural vehicles doing less than 1.5km on road between fields, and steam engines.