► How UK new car market fared last year

► Final full-year figures for 2022

► Lowest sales total since 1992

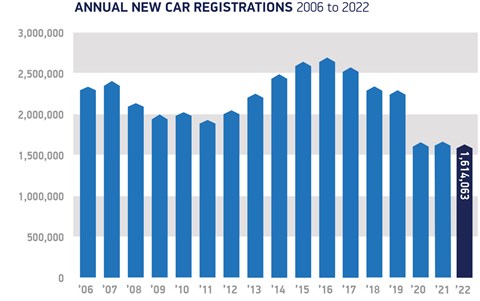

In case you hadn’t noticed, the new-car market remains volatile – and new figures released today show that Brits bought 2% fewer cars in 2022 than they did the year before. It’s the worst performance since 1992.

The Society of Motor Manufacturers and Traders (SMMT) reported sales of 1.61 million vehicles last year, as supply was constrained by ongoing shortages of semi-conductors and the chaos wrought by nearly three turbulent years of pandemic slowdowns, parts shortages and war in Ukraine.

The official figures are down on the 1.65m registrations in 2021 and the 1.63m of 2020 – and some 700,000 cars short of pre-Covid levels which topped 2.3m as recently as 2019. It proves just how deep and painful the contraction of the past three years has been.

Our analysts have pored over the SMMT data to provide a detailed UK 2022 car sales analysis, with a full breakdown of the UK’s bestselling brands and models.

Sales shrinking, but UK regains its place as Europe’s second biggest car market

Britain had slipped behind France in 2021 sales, but the SMMT confirmed that the UK was now once again the second largest new-car market behind Germany, which is on course for 2.5m+ registrations in 2022.

It’s not all doom and gloom – there are some green shoots of recovery visible in the UK’s new-car market: December was the fifth consecutive month of growth, up 18% year-on-year, but the stronger second half couldn’t make up for the sluggish first six months of 2022.

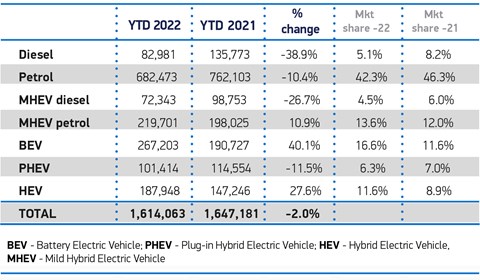

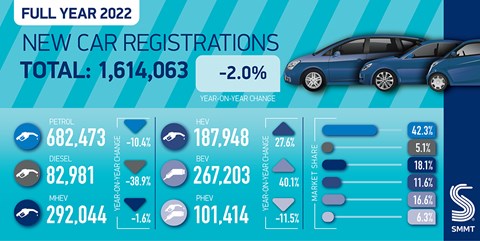

The figures reveal how electrification is changing the kinds of vehicles new-car buyers are choosing.

Full battery electric vehicles (BEVs) continue to rise in popularity across Britain, accounting for 16.6% of all new cars sold last year; they have now overtaken diesel to become the second most common powertrain.

The UK’s bestselling cars of 2022

Drumroll please… In a surprise twist, the British-built Nissan Qashqai (below) raced to the top of the leaderboard, overtaking the Vauxhall Corsa to the top spot. Incredibly, the Qashqai represents 1 in 5 of all cars built in Britain since 2007.

And if you wondered why you see so many Teslas on the road, take a bow the Model Y. It was the third most popular car overall among British new-car buyers of 2022:

- Nissan Qashqai

- Vauxhall Corsa

- Tesla Model Y

- Ford Puma

- Mini hatchback

- Kia Sportage

- Hyundai Tucson

- VW Golf

- Ford Kuga

- Ford Fiesta

It’s interesting to note that six of the top 10 are crossovers or SUVs, in some form or other. Hatchbacks are very much in the descendency…

Bestselling EVs of 2022

The same pattern is repeated with the biggest-selling electric cars last year, with those shiploads of Teslas clearing out the top two spots:

- Tesla Model Y

- Tesla Model 3

- Kia e-Niro

- VW ID.3

- Nissan Leaf

- Mini hatchback

- Polestar 2

- MG 5

- BMW i4

- Audi Q4 e-Tron

An analysis of how each brand performed in 2022 reveals tough trading conditions across the board, but many brands still managed to grow their market share.

Winners and losers: which brands sold the most cars in 2022 – and who tanked

As ever, the end-of-year report provides an opportunity to see who’s flying, and who’s fumbling. Key movers and shakers include:

- The UK’s biggest car brands in 2022 How the world has changed: VW is Britain’s most popular car brand (132k sales), followed by Ford (126k), Audi (110k), BMW (109k), Toyota (102k) and Kia (100k)

- Electric brands prospered The likes of MG (up 67%) and Polestar (a 79% increase) proved that all-electric brands who can provide supply are well positioned to captialise on interest in EVs

- Tesla becomes a major player The biggest EV outfit of them all – Tesla – now commands a 3.4% market share, and is more than four times bigger than Jaguar

- Niche brands suffer We’ve been observing it for years: but how much longer can the likes of Subaru (down 34% to just 1391 registrations) continue to operate in the UK? 2022 was the first year with no new Mitsubishi registrations, as the Japanese importer pulled out of the British market

- New arrivals make their mark Genesis rolled out its UK launch to claim a round 1000 registrations; look out for GM Ora, too, whose Funky Cat managed 68 sales. Expect to see more new names in the months ahead as EV start-ups eye the British market

- The Koreans are on a roll Hyundai (up 15%) and Kia (up 10%) continue to grow

Check out the full table of 2022 new-car sales figures from the SMMT here. (Tip for smartphone users: flip sideways to landscape view to see the full table!)

| MARQUE | 2022 SALES | SHARE | 2021 SALES | SHARE | UP OR DOWN? |

| Abarth | 1544 | 0.10% | 2335 | 0.14% | -33.9% |

| Alfa Romeo | 1576 | 0.10% | 1574 | 0.10% | +0.1% |

| Alpine | 288 | 0.02% | 202 | 0.01% | +42.6% |

| Audi | 110,144 | 6.82% | 117,953 | 7.16% | -6.6% |

| Bentley | 1629 | 0.10% | 1348 | 0.08% | +20.9% |

| BMW | 108,624 | 6.73% | 116,577 | 7.08% | -6.8% |

| Citroen | 28,487 | 1.76% | 30,204 | 1.83% | -5.7% |

| Cupra | 14,383 | 0.89% | 7584 | 0.46% | +89.7% |

| Dacia | 27,221 | 1.69% | 17,568 | 1.07% | +55.0% |

| DS | 3674 | 0.23% | 2362 | 0.14% | +55.6% |

| Fiat | 19,698 | 1.22% | 20,154 | 1.22% | -2.3% |

| Ford | 126,826 | 7.86% | 116,305 | 7.06% | +9.1% |

| Genesis | 1000 | 0.06% | 127 | 0.01% | +687.4% |

| GM Ora | 68 | 0% | 0 | 0% | 0% |

| Honda | 24,084 | 1.49% | 26,928 | 1.63% | -10.6% |

| Hyundai | 80,419 | 4.98% | 69,680 | 4.23% | +15.4% |

| Jaguar | 12,165 | 0.75% | 18,868 | 1.15% | -35.5% |

| Jeep | 2525 | 0.16% | 4463 | 0.27% | -43.4% |

| Kia | 100,191 | 6.21% | 90,817 | 5.51% | +10.3% |

| Land Rover | 43,180 | 2.68% | 53,111 | 3.22% | -18.7% |

| Lexus | 10,675 | 0.66% | 13,878 | 0.84% | -23.1% |

| Maserati | 720 | 0.04% | 765 | 0.05% | -5.9% |

| Mazda | 25,209 | 1.56% | 25,852 | 1.57% | -2.5% |

| Mercedes-Benz | 80,910 | 5.01% | 97,945 | 5.95% | -17.4% |

| MG | 51,050 | 3.16% | 30,600 | 1.86% | +66.8% |

| Mini | 45,854 | 2.84% | 45,756 | 2.78% | +0.2% |

| Mitsubishi | 0 | 0.00% | 5125 | 0.31% | 0% |

| Nissan | 76,711 | 4.75% | 68,494 | 4.16% | +12% |

| Peugeot | 52,264 | 3.24% | 61,106 | 3.71% | -14.5% |

| Polestar | 7345 | 0.46% | 4096 | 0.25% | +79.3% |

| Porsche | 18,267 | 1.13% | 13,702 | 0.83% | +33.3% |

| Renault | 32,285 | 2.00% | 29,836 | 1.81% | +8.2% |

| Seat | 22,140 | 1.37% | 43,130 | 2.62% | -48.7% |

| Skoda | 48,848 | 3.03% | 55,561 | 3.37% | -12.1% |

| Smart | 1256 | 0.08% | 1581 | 0.10% | -20.6% |

| Ssangyong | 1536 | 0.10% | 1525 | 0.09% | +0.7% |

| Subaru | 1391 | 0.09% | 2107 | 0.13% | -34% |

| Suzuki | 17,378 | 1.08% | 20,976 | 1.27% | -17.2% |

| Tesla | 54,622 | 3.38% | 34,853 | 2.12% | +56.7% |

| Toyota | 102,181 | 6.33% | 100,895 | 6.13% | +1.3% |

| Vauxhall | 83,691 | 5.19% | 91,452 | 5.55% | -8.5% |

| Volkswagen | 131,850 | 8.17% | 147,826 | 8.97% | -10.8% |

| Volvo | 36,506 | 2.26% | 48,260 | 2.93% | -24.4% |

| Other British | 2167 | 0.13% | 2206 | 0.13% | -1.8% |

| Other imports | 1481 | 0.09% | 1494 | 0.09% | -0.9% |

| TOTAL | 1,614,063 | 100% | 1,647,181 | 100% | -2.01% |

Compare last year’s performance with the previous analyses from 2021 and 2020 in the stories below:

2021 new-car sales analysis

2020 UK new car sales winners and losers