► New car sales analysis 2020

► Worst year for UK sales since 1992

► Covid-19 slashes market by 29%

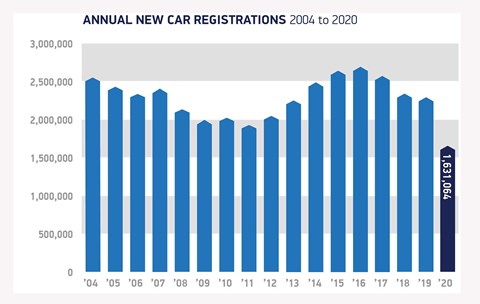

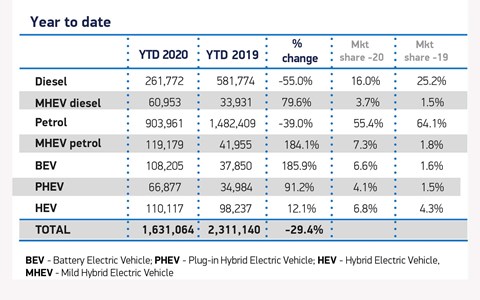

The full extent of the damage wrought by the Covid-19 pandemic was revealed today, as official figures confirmed that the UK’s new-car market slumped by 29.4% in 2020 as buyers stayed away from dealerships during lockdown.

It was the worst year for new vehicle registrations since 1992, according to new data published by the Society of Motor Manufacturers and Traders (SMMT). Few observers were surprised, after months of lockdown forced showrooms to close, consumer confidence ebbed away and unemployment edged upwards.

A total of 1,631,064 new vehicles were registered last year, compared with 2.3 million in 2019 (itself the worst period for seven years). The industry was already expecting sluggish sales with the spectre of Brexit disrupting buyer confidence and supply chains, but nobody 12 months ago would have foreseen the carnage that was caused by the spread of coronavirus.

The full extent of the collapse in new-car sales can be seen by comparing it with other years:

Mike Hawes, the chief executive of the SMMT, said: ‘2020 will be seen as a “lost year” for automotive, with the sector under pandemic-enforced shutdown for much of the year and uncertainty over future trading conditions taking their toll. However, with the rollout of vaccines and clarity over our new relationship with the EU, we must make 2021 a year of recovery.’

Trend-spotting: which cars we bought in 2020

There were few surprises at the top of the sales chart, barring the impressive speed at which the Ford Puma and Volvo XC40 have muscled their way into the top 10. It’s a reflection of the appeal of compact family crossovers – and Ford’s evergreen Fiesta retained its top spot:

- Ford Fiesta 49,174

- Vauxhall Corsa 46,439

- VW Golf 43,109

- Ford Focus 39,372

- Mercedes A-Class 37,608

- Nissan Qashqai 33,972

- Mini hatchback 31,233

- VW Polo 26,965

- Ford Puma 26,294

- Volvo XC40 25,023

The fuels we bought continue to change at an impressive pace. The demonisation of diesel has led to further falls in derv’s popularity – pure diesel cars have crashed from a quarter of sales in 2019 to just 16% last year, although nearly 4% of new cars registered in 2020 were in fact mild hybrid diesels.

Should you still buy a diesel car in 2021?

But the trend is clear: electrification is taking hold and a total of 108,205 pure battery electric vehicles (BEVs) were sold last year, making up an impressive 6.6% of the market, up from just 1.6% a year earlier. Hybrids grew at a more modest 12%, with 110,117 sold, while plug-in hybrids (PHEVs) grew by 91% with 66,877 registered:

Winners and losers: Britain’s new-car registrations in 2020 in full

Analysing the full figures confirms that the pain was shared across the board. Only comeback kid MG could post growth last year, up 41% to 18,400 registrations, buoyed by the swelling ranks of its SUVs and electric models – bang on the zeitgeist.

Figures seen by CAR suggest also that Tesla continued to sell strongly – nearly doubling sales, thanks to the arrival of the Model 3; despite not releasing its figures in the SMMT breakdown, we understand that the EV specialist sold 24,766 vehicles in Great Britain last year.

The market fell by nearly a third, suggesting that the following brands posting larger falls should be on the watchlist in 2021:

- Citroen -44.8% Just 28,000 UK sales last year for Citroen, squashing it to half the size of sister brand Peugeot and smaller than Renault, too

- DS -44.7% Citroen’s upmarket arm is struggling to resonate in a tough marketplace: just 2400 registrations in 2020

- Hyundai -43% Surprise above-average fall for the Korean brand, despite healthy flow of new metal

- Mazda -43.4% Switchover of models and supply restrictions meant Mazda sales dropped to just shy of 23,000 last year

- Mitsubishi -44.0% The brand’s European retreat bites, as sales tumbled to just 9000 cars

- Smart -65.8% Smart suffered one of the biggest slumps of any major brand; small cars aren’t big business right now…

- Subaru -68.3% Japanese brand has become a bit-part player in the UK, registering just 951 sales last year

- Suzuki -43.4% Despite having a supply of modish SUVs and small cars, Suzuki struggled to keep up in 2020

- Vauxhall -40.3% One of the biggest shocks was just how far Vauxhall fell – now overtaken by Ford, Volkswagen, Audi, BMW and Mercedes-Benz – as the Griffin focuses on profitable sales, not pile-’em-high volume sales

Elsewhere, every single manufacturer posted drops in new vehicle registrations, many of them considerable. The full breakdown of 2020 new-car sales is as follows. (Tip to smartphone users: tilt your phone in landscape mode to see the full table!).

| MARQUE |

2020 SALES |

% MARKET SHARE |

2019 SALES |

% MARKET SHARE |

UP OR DOWN? |

| Abarth |

2349 |

0.14 |

3,448 |

0.15 |

-31.9% |

| Alfa Romeo |

2107 |

0.13 |

3,413 |

0.15 |

-38.3% |

| Alpine |

105 |

0.01 |

171 |

0.01 |

-38.6% |

| Audi |

107,842 |

6.61 |

138,924 |

6.01 |

-22.4% |

| Bentley |

1337 |

0.08 |

1,595 |

0.07 |

-16.2% |

| BMW |

115,476 |

7.08 |

169,753 |

7.34 |

-32.0% |

| Chevrolet |

0 |

0.00 |

62 |

0.00 |

0.00 |

| Citroen |

28,059 |

1.72 |

50,806 |

2.20 |

-44.8% |

| Cupra |

162 |

0.01 |

0 |

0.00 |

0.00 |

| Dacia |

18,918 |

1.16 |

30,951 |

1.34 |

-38.9% |

| DS |

2379 |

0.15 |

4,299 |

0.19 |

-44.7% |

| Fiat |

19,253 |

1.18 |

29,890 |

1.29 |

-35.6% |

| Ford |

152,777 |

9.37 |

236,137 |

10.22 |

-35.3% |

| Honda |

27,297 |

1.67 |

43,913 |

1.90 |

-37.8% |

| Hyundai |

47,507 |

2.91 |

83,284 |

3.60 |

-43.0% |

| Infiniti |

0 |

0.00 |

292 |

0.01 |

0.00 |

| Jaguar |

25,513 |

1.56 |

36,069 |

1.56 |

-29.3% |

| Jeep |

4639 |

0.28 |

6,193 |

0.27 |

-25.1% |

| Kia |

70,537 |

4.32 |

97,323 |

4.21 |

-27.5% |

| Land Rover |

58,505 |

3.59 |

76,546 |

3.31 |

-23.6% |

| Lexus |

13,727 |

0.84 |

15,713 |

0.68 |

-12.6% |

| Maserati |

585 |

0.04 |

933 |

0.04 |

-37.3% |

| Mazda |

22,742 |

1.39 |

40,148 |

1.74 |

-43.4% |

| Mercedes-Benz |

110,883 |

6.80 |

171,823 |

7.43 |

-35.5% |

| MG |

18,415 |

1.13 |

13,075 |

0.57 |

+40.8% |

| Mini |

46,109 |

2.83 |

64,884 |

2.81 |

-28.9% |

| Mitsubishi |

9076 |

0.56 |

16,199 |

0.70 |

-44.0% |

| Nissan |

71,932 |

4.41 |

92,372 |

4.00 |

-22.1% |

| Peugeot |

57,186 |

3.51 |

80,851 |

3.50 |

-29.3% |

| Polestar |

850 |

0.05 |

0 |

0.00 |

0.00 |

| Porsche |

14,284 |

0.88 |

15,257 |

0.66 |

-6.4% |

| Renault |

42,740 |

2.62 |

59,132 |

2.56 |

-27.7% |

| Seat |

45,419 |

2.78 |

68,798 |

2.98 |

-34.0% |

| Skoda |

58,693 |

3.60 |

75,053 |

3.25 |

-21.8% |

| Smart |

1377 |

0.08 |

4,022 |

0.17 |

-65.8% |

| Ssangyong |

1488 |

0.09 |

1,930 |

0.08 |

-22.9% |

| Subaru |

951 |

0.06 |

2,997 |

0.13 |

-68.3% |

| Suzuki |

19,838 |

1.22 |

35,065 |

1.52 |

-43.4% |

| Tesla |

24,766 |

1.5 |

13,145 |

0.57 |

+88% |

| Toyota |

91,793 |

5.63 |

105,192 |

4.55 |

-12.7% |

| Vauxhall |

95,444 |

5.85 |

159,830 |

6.92 |

-40.3% |

| Volkswagen |

148,338 |

9.09 |

200,771 |

8.69 |

-26.1% |

| Volvo |

46,408 |

2.85 |

56,208 |

2.43 |

-17.4% |

| Other British |

1938 |

0.12 |

3,183 |

0.14 |

-39.1% |

| Other imports |

26,086 |

1.60 |

14,635 |

0.63 |

+78.2% |

| Total |

1,631,064 |

100 |

2,311,140 |

100 |

-29.4% |

Michael Woodward, UK automotive lead at Deloitte, said: ‘2020 saw 29% fewer new cars on the road than in 2019, marking a fourth consecutive year of declining sales and suggesting the fallout may be felt for some time still. However, many manufacturers and dealers remain optimistic for the year ahead, in spite of the latest UK lockdown measures. Whilst showrooms will be closed as in previous lockdowns, manufacturing facilities are expected to remain open this time. For dealers, click and collect, MOT and repair services also remain permitted offering a valuable, and profitable, lifeline.’

Further UK new-car sales analysis

Full breakdown of 2019 UK new-car sales figures

2018: who bought which cars?

A look at the new-car market in 2017