► Analysis of Stellantis CEO departure

► Carlos Tavares quits suddenly

► We look at the reasons why

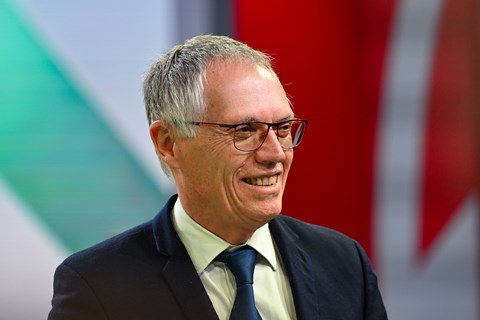

Stellantis CEO Carlos Tavares has quit suddenly after a boardroom dispute at one of the world’s biggest car-making groups. He had earlier announced his intention to step down in 2026, but he left with immediate effect at the weekend a year earlier than planned.

He founded and led the car super-group that comprises Fiat, Vauxhall, Jeep, Peugeot, Citroen and Chrysler since its inception in 2021 and gained a reputation as a scale and cost-focused leader. One of his final moves last week was to announce plans to close Vauxhall’s Luton van-making plant, putting 1100 jobs at risk in the UK.

Senior independent director Henri de Castries revealed there had been a disagreement over strategy at the very top of the company. ‘Stellantis’s success since its creation has been rooted in a perfect alignment between the reference shareholders, the board and the chief executive,’ he told reporters. ‘However, in recent weeks different views have emerged which have resulted in the board and the chief executive coming to today’s decision.’

The reason why Carlos Tavares was ousted from Stellantis

America lifted Stellantis CEO Carlos Tavares to prominence, but in a cruel twist of fate the country could also be responsible for the downfall of an executive who will be remembered for stitching together 14 brands, many of them financially shaky, into an automotive powerhouse.

Stuttering sales in North America this year forced the company to issue a humiliating warning to investors in late September that it would deliver 200,000 fewer cars there this year than planned.

So crucial are US sales of Jeep SUVs and Ram pick-ups to Stellantis’s income that the company downgraded its predicted profit margin for the full year to between 5.5 and 7.0 per cent, from 13 per cent last year.

For a company that measures success on profit margins rather than sales volumes or revenue, the adjustment was devastating. The fallout was immediate. Head of US operations Carlos Zarlenga was ousted, along with global chief financial officer Natalie Knight and the head of Europe, Uwe Hochgeschurtz.

Tavares kept his position but the company announced he would leave when his current contract expires in 2026. The decision was his, ‘after listening carefully to my wife, my kids’, he told journalists at the 2024 Paris motor show.

Tavares blamed a poor second-quarter marketing plan for not driving enough customers to the company’s 2500 dealers in the US. His management style is hands-off enough to justify axing Zarlenga’s job while keeping his own. ‘The marketing plan that failed was proposed and decided by the region,’ he said in Paris. ‘I saw that it was risky. I could have stopped it. I didn’t.’

The sales downgrade in the US is the more painful given Tavares’s positive experience there, serving as president of Nissan North America from 2009. ‘He cut his teeth in America. His success there is what made him,’ said Andy Palmer, who worked alongside Tavares at Nissan under Carlos Ghosn.

Costs, costs, costs…

Like Ghosn – dubbed Le Costcutter – Tavares worked to relentlessly chip away at encrusted fixed costs until the underlying profitability is revealed. That was his modus operandi when he jumped ship in 2014 to take over as CEO of PSA Peugeot-Citroën and again when he added Vauxhall/Opel in 2017 after buying it from GM.

Merging PSA with FCA Fiat-Chrysler to create Stellantis in 2021 was the culmination of Tavares’s desire to streamline production and development by sharing parts and assembly lines, while still keeping the brands distinct.

As Ghosn also found out, powerful forces are arrayed against car industry leaders who plot lean global operations with a reduced workforce and fewer plants.

‘The evidence is clear that CEO Carlos Tavares is steering Stellantis on a crash course that will cause our members tremendous harm,’ the United Auto Workers (UAW) in the US thundered late in September, claiming Stellantis was reneging on previous commitments and planning to lay off workers amid reduced production.

Rivals are sniffing the blood in the water. ‘You can’t cut your way to growth, no way,’ GM president Mark Reuss told investors recently in a remark almost certainly aimed at Stellantis.

Like most European car makers, Stellantis has yet to crack the code on EV cost parity with combustion engine cars. Shifting regulations also screw up planning and add cost, which of course Tavares hates. ‘Carlos is the most consistent guy I know,’ said Jean-Philippe Imparato, the outgoing CEO of Alfa Romeo, new head of Europe and a potential candidate to take over from Tavares.

Consistency in good times, however, can seem like intractability in bad. Tavares’s answer to shrinking profits is more cost cutting and management reshuffling, with 21 senior management changes in the last 12 months, according to sums by analysts at Bernstein.

It’s ironic that the next casualty turned out to be Tavares himself. He leaves behind a reputation as perhaps the most tenacious car executive in the toughest automotive era.